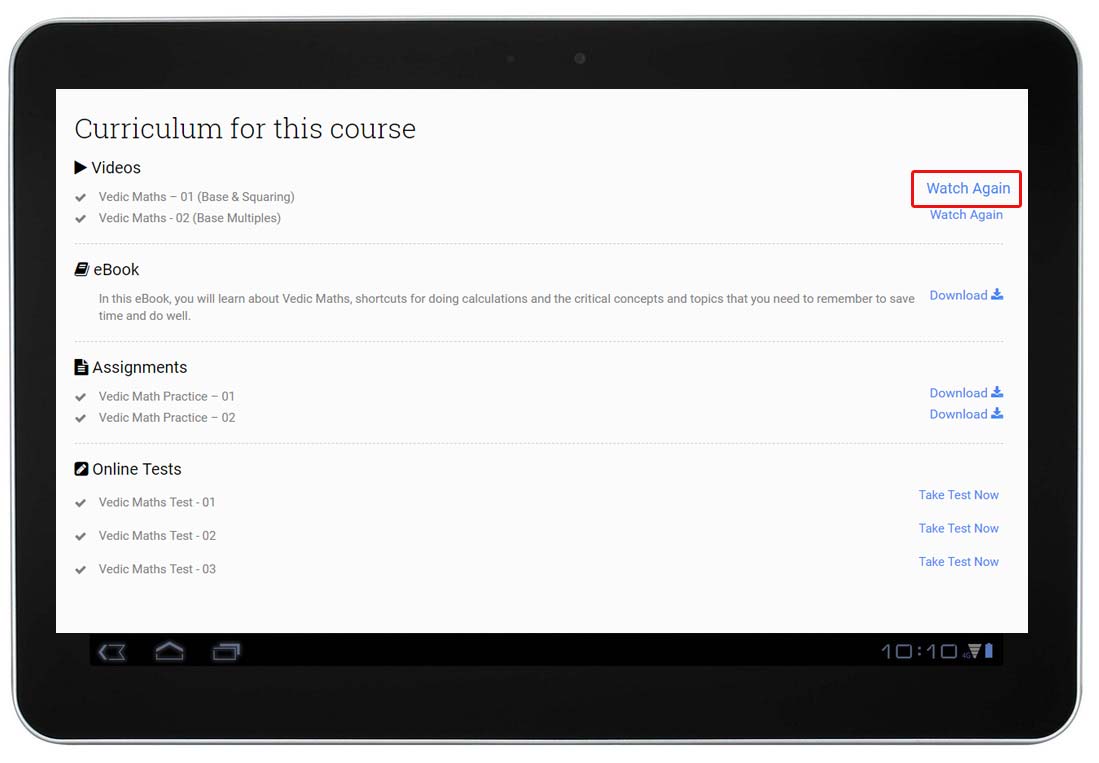

Our expert academic team takes you on a journey of step-by-step learning using visually interactive lectures

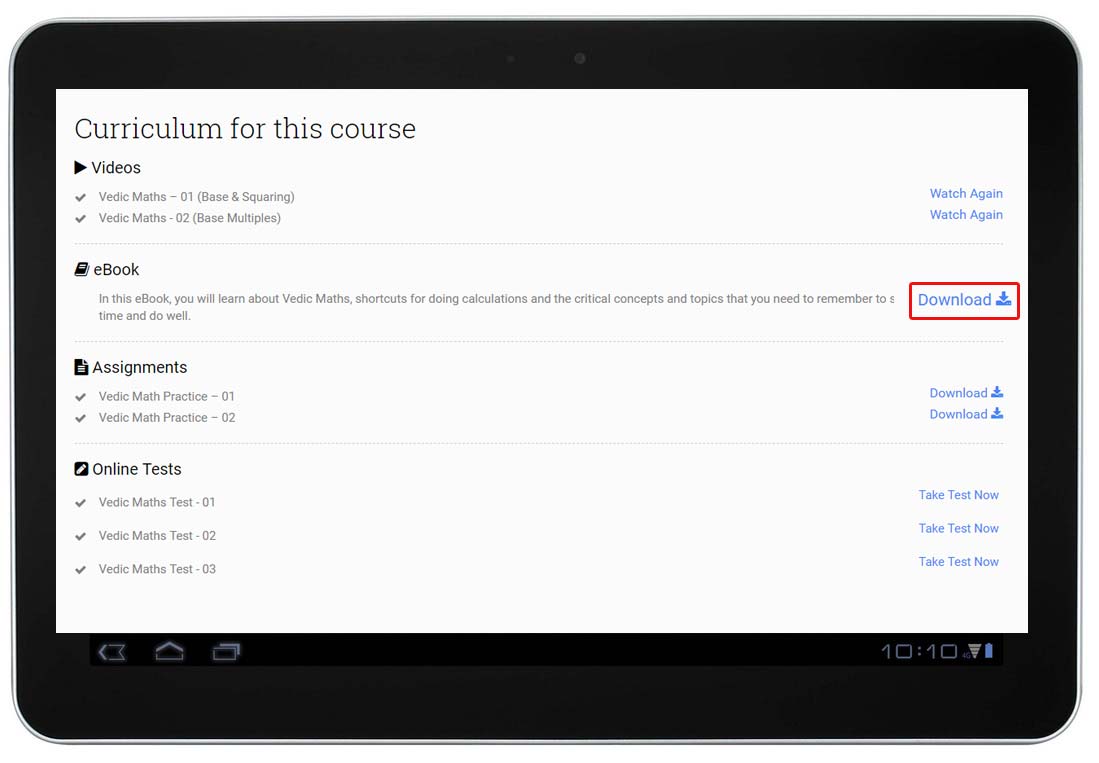

Gain momentum with complementary reading from our state of the art e-library

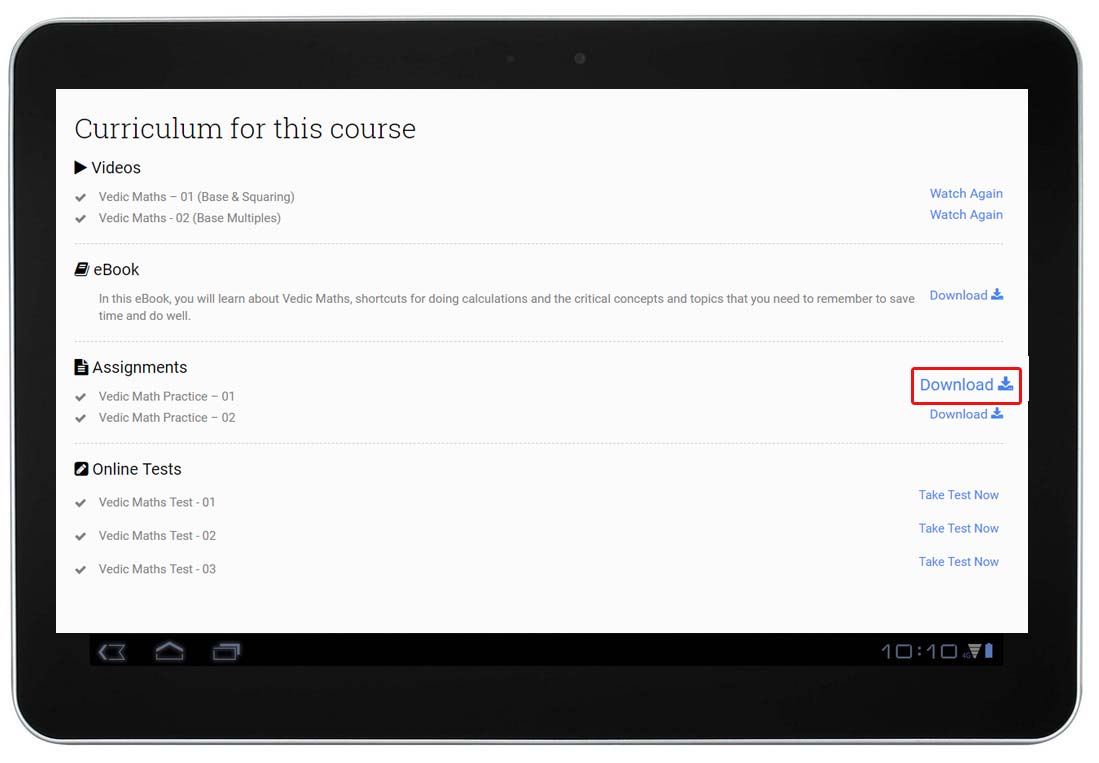

Refine the skills you acquire through meticulously-structured assignments and practice questions

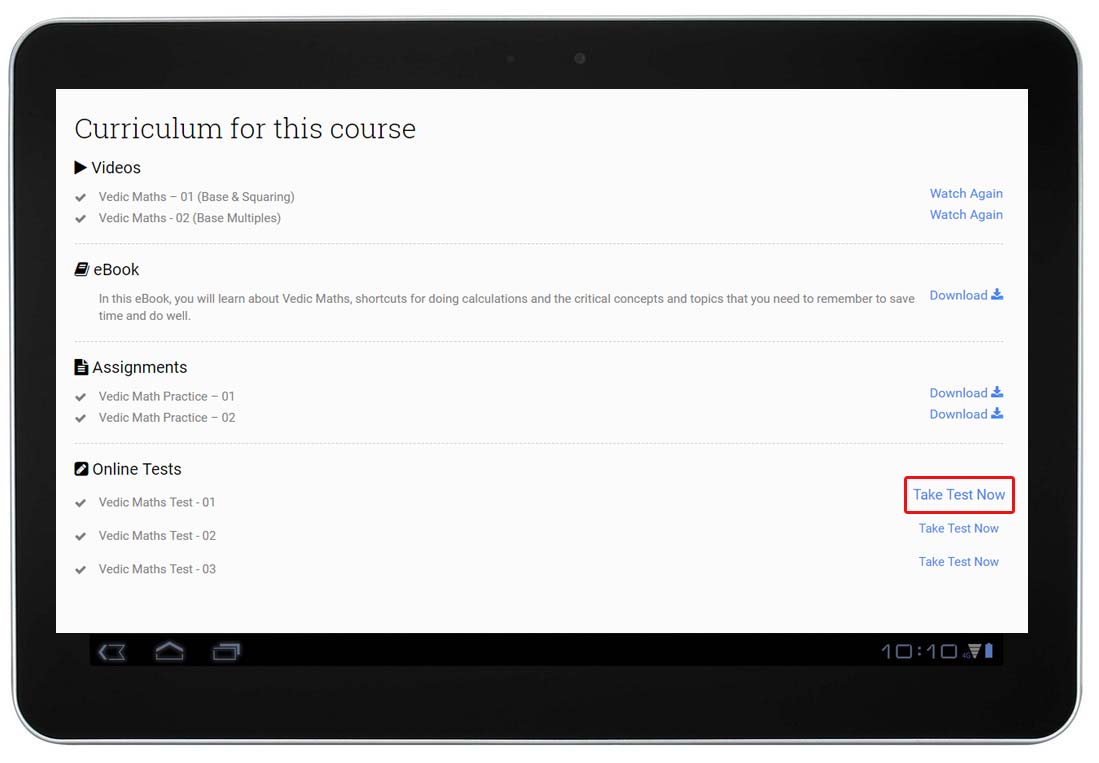

Benchmark your progress by taking tests that simulate actual exam environment

Anoop Ohri has an MBA degree from IIM Lucknow with a background in Commerce. He is a brilliant facilitator and has been associated with Banking Industry while also working as a Freelance Consultant. Mr Ohri’s decades of experience in the field and the fact that he has excellent insight into the world of management makes him the ideal mentor for aspirants looking to make it big in this profession.

Anil Sharma has an MBA degree in Strategy and Marketing from Management Development Institute, Gurgaon and a B. Com from Shri Ram College of Commerce, Delhi University. Mr Sharma is an avid reader and a sports enthusiast, with a keen interest in capital markets. He has been an active member of Bullseye interview preparation team for the last 2 years. With decades of experience in corporate banking, he is the perfect teacher to help students clear critical hurdles during campus placements & other entrance tests.

Indirect tax is the tax levied on transactions rather than individuals. As opposed to multiple indirect taxes in the past, India now has one GST. What are its key features, components & pros and cons?

This chapter is devised to provide you with a comprehensive overview of GST. The course is equipped with eBooks, videos and assignments to acquaint you with the basics of indirect taxation system including GST.